Last week we looked at how a non-resident individual who owns property in Canada would report rental income. With this week’s topic, we’ll look at what non-residents who want to sell their property would need to do in terms of reporting this property.

The easy answer is that a resident would have to report capital gain or business income on their T1 personal tax return. However, non-residents face further complexities because the Canadian government does not want to chase after a non-resident to pay their taxes. Therefore it has established a system which requires the non-resident to pay and remit withholdings tax and subsequently file a tax return the following year to potentially recoup some of the funds back in the form of a refund when they file a non-resident return.

Let’s look at Leon’s situation from the previous blog.Leon had purchased a property in 2018 and had filed his rental S.216 returns in 2018 and 2019. The requirement was for him to get an Individual Tax Number (ITN) by filing form T1261. Please read the other blog here to see how you can acquire one.

We are now in the year 2020 and Leon has decided to sell his Canadian condo and use the funds to buy a house for himself in the States. His friend Jerome who initially helped him with the purchase in 2018 has since moved on from the real estate business and he gets a referral to talk to Lara. An experienced real estate professional, she immediately does her comparable and figures out the listing price that makes sense.

Outside of selling the property, Lara is aware that there will have to be withholdings tax on the sale of the property, she immediately tells Leon to contact his accountant to find out what his options are.

Leon’s accountant tells him there are 2 options.

The first option (which is not the most desirable) is to notify a lawyer once you have received and accepted an offer on your property. The lawyer will have to do a withholdings tax of 25% on the sale price.

For example, let’s say the property in question was purchased for $500k in 2018 and Leon has taken advantage of the hot Canadian market and now sold the unit for $650k. If he doesn’t elect for any deductions the lawyer would have to withhold 25% of $650k which would mean $162,500 would be withheld and sent to the government. This is a significant amount of funds and in most cases a large amount of the profit for an individual.

Most lawyers ask for a SIN to finalize a sale to make sure someone is a resident of Canada, however someone can have a SIN and be a non-resident. The onus is on the selling agent and the seller to disclose this, or else the CRA goes after the buyer and puts a lean on the property that is being sold. It is unfair treatment, but the CRA does not want to chase a non-resident to get paid for a capital gain.

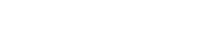

So with this first option above the non-resident can then file a full non-resident tax return and report their expenses related to the property and receive a large chunk of the taxes back as a refund. As long as the property was not purchased with the intention of a short period return (speculative purchase) and they sold it within a reasonable number of years later (note that the number of years not defined in the income tax act) that individual can sell that property and only pay capital gains tax. How is Capital Gains Tax calculated you ask?

However if this person earns a low income in their own country (below $11k for the year) they are able to get an exemption up to that first $11k like any resident in Canada and potentially lower the tax liability even further.

If Leon had not made any election he would have had $162,500 withheld and with the help of his accountant file a tax return to get $153,065 back as a refund from the Canadian Government.

I have dealt with many such filings with CRA and there is no specified turnaround for these types of non-resident returns, they are usually on a first in first out basis and CRA does not have enough resources to file these quickly, also sometimes these returns are quite complex, the example above is a very simple one.

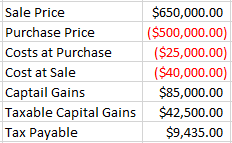

Leon’s accountant suggested a second option: an election T062 Request by a Non-Resident of Canada for a Certificate of Compliance Related to the Disposition of Taxable Canadian Property. What this election would do is request that the Canadian government only withhold 25% of sale price minus purchase price and costs incurred during original purchase. This formula wouldn’t include the real estate fees and the legal fees on sale because an individual is applying for this election before the sale is completed. Even if it is after disposition the CRA has a stance not to consider final closing costs.

This concept was intriguing to Leon because it meant the withholdings tax would be significantly lower. Lara was quite successful in receiving multiple offers on this unit that within 2 weeks Leon confirmed to sell the property for $650k the figure that Leon was happy from the beginning to sell the unit for. So now Leon asked his accountant to prepare the election and fill in the T2062 form. Upon preparing the documents and putting together all the requests including prior rental returns filed for this unit. The accountant came to the amount the lawyer would need to withhold to remit to CRA.

This figure is a far cry from the original withholdings tax of $162,500 however in order for Leon to get a refund back on the extra taxes withheld he will still need to file the non-resident return.

Leon’s accountant filed the election form with the proper documents and Leon’s lawyer held out remitting the withholdings tax to CRA until Leon’s accountant was able to acquire the certificate of compliance on the disposition of the property.

He still has some work to do when it comes to filing his taxes the following year, and it is important to make sure he files with a professional accountant so that he received the best advice.

This was a simpler case, but if Leon had decided to sell the property in a short period of time the CRA may have considered the property sold as a “speculation sale” and thus charged business tax on the unit. To get a clearer picture on what this means and what are the taxes involved, please read my assignment article here which have the same conditions and repercussions when selling a property in a short period of time. See you next week for another blog… Please feel free to email me a specific topic that interests you and I will make every effort to write about it.

See you next week for another blog… Please feel free to email me a specific topic that interests you and I will make every effort to write about it here.