It’s been a while since I’ve been able to write a blog. Personal life has taken a big chunk of my time, after getting married and with the birth of our son it’s been a challenge to find the time. He is now 1 year old and can give both myself and my wife some time to wind down when he naps, which gives me the opportunity to sit down and write these blogs.

I am writing today about a topic that has been a challenge to non-resident Canadians for a very long time now – owning a property while residing outside of Canada. Many non-residents who own property in Canada are challenged in understanding the income tax act, and how it applies to them when it comes to owning property or properties.

First is the issue of requirements, which includes having either a Social Insurance Number (SIN) or an Individual Tax Number (ITN). Social Insurance Numbers are granted to residents/citizens of Canada through application and allow you to invest or work in Canada – including owning a property. Alternatively, those who are not eligible for a Canadian SIN apply for Individual Tax Numbers by filing form T1261, which is subsequently filed with the income tax return. T1261 forms are not easy to file, for your own benefit enlist the help of a professional to file it.

Second and most important is the issue of withholding taxes. Non-residents of Canada who collect rental income are required to pay the government 25% of this income to an NR tax account as a withholding tax.

What does this mean? Let’s look at an example below.

Leon is a non-resident of Canada, he has always lived in the US from birth, although he’s visited Canada on numerous occasions. When he was 30 years old, he visited Canada and one of his friends Jerome, a real estate agent, showed him the benefits of investing in Toronto’s great real estate market.

Leon was intrigued and he purchased a property in the downtown Toronto market with the help of his friend. He decided to rent it out to a Canadian Resident.

Jerome told Leon that he may want to consult with an accountant about the tax implications and how he should go about reporting. He also introduced Leon to a Property Management expert, Dana, to explain to Leon how to go about remitting taxes. Due to the complexities of withholding tax and filing taxes as a non-resident, Leon would be in a better position to hire a property management firm to take care of his needs.

He is a non-resident and shouldn’t have to come to Canada every time he needs to replace a tenant or deal with maintenance issues. Also, dealing with the government is a situation better left handled by professionals. The Property Manager would open an NR tax account for his/her client and remit taxes (25% of total rental income) on a monthly basis for them from the gross monthly rentals collected, deduct their fees and send the rest to the client.

Once the calendar year is done, the property manager would prepare the numbers to send to the accountant so that they can prepare NR4 forms to file the personal taxes with the government.

Conversely if the non-resident decides to file taxes themselves they will have to remit the withholding tax every month on the 15thfollowing the month of rent collection. Once the calendar year has passed, they will need to send a letter to the CRA and request an NR4 form to be prepared for them.

If anyone knows the processing time of the CRA for anything this could take multiple requests and take several months. NR4 forms needs to be filed by the 31stof March by all accountants to avoid any penalties charged to the non-resident NR accounts.

Back to our example above… Leon decided to enlist the help of Dana to have his property management taken care of from the tenant side and the government remittance side of things. She took care of remitting the taxes on the 15thof every month following the receipt of rent, and took care of every issue his tenant had.

Once the year was over, the property management’s accountant was given the information, filed the NR4 form and issued one to Dana to pass onto Leon. Leon then enlisted a designated accountant to file the Income tax return.

A non-resident Canadian does not need to report any income that they earn outside of Canada. They only report their rental income and any expenses paid towards that rental property. After including the taxes that were withheld, they will get the majority of the withholding tax as a tax refund.

Looking at our example above…

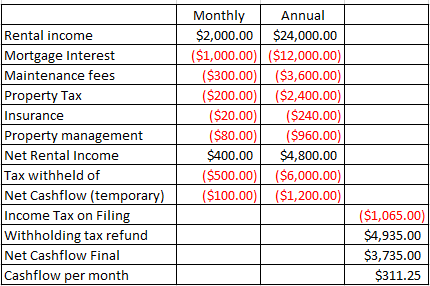

Leon receives 2k in rental income every month, Dana withholds $80 per month in property management fees, and 25% of the 2k for CRA withholding tax.

He has the following monthly expenses:

When Leon files his tax return and on an annual basis reports an annual income of $24,000 with income tax withheld of $4,800. With his net rental income at $4,800 (minus any other small expenses like accounting fees etc.…), his taxes will be around $1,065 – totaling around 22%.

This means that Leon will receive a refund of $3,735, meaning his net cash flow from this investment would be around $311 a month when it’s all said and done.

Non-residents would also have the ability to remit taxes on the net rental income basis (rental revenue minus all rental expenses) by completing an NR6 form. Note that most property management firms do not offer filing through this method as it creates additional responsibilities and penalties for non-compliance. The non-resident cannot request to file an NR6 form themselves, as it must be completed through an agent and that agent cannot be a family member. Even though there is a turnaround time for CRA to process your return and give you back your refund, it really is a short term cash flow issue when you think about it.

A few years have passed since Leon purchased his property and he has now decided to sell it. He’s wondering what he’s supposed to do, and what forms he needs to file. Tune in next week to read my article on selling your property as a non-resident.